Since the emergence and exponential growth of cryptocurrencies over the past decade, a rising concern for many people is the energy required to maintain blockchains and process transactions.

The processing power needed to mine and transact cryptos is often remarkably high, and it is exacerbated by wherever the mining takes place and the energy format the location is reliant on.

Of course, not all crypto tokens have been created equal when it comes to energy consumption, while a growing number of green coin options and cryptocurrencies are among the third generation of blockchains.

So, while Bitcoin, Litecoin, and other coins continue to dominate the market, more and more eco-friendly alternatives are emerging, and many established currencies are switching their systems to become greener.

In this guide, we’ll take a closer look at so-called “green” power coin tokens and cryptocurrencies, while asking which tokens are leading the way on this front in 2023!

What is the Environmental Impact of Crypto?

Despite the variable mining requirements of individual tokens, there’s no doubt that sourcing and maintaining cryptocurrencies has a direct impact on the natural environment.

To put this into context, it’s thought that such processes contribute approximately 0.3% of global CO2 emissions. Although this may not seem like a lot, it’s measured as more than the combined emissions produced by Norway, Switzerland and Croatia.

We’ll take a closer look at individual tokens below, but in the case of Bitcoin (BTC) alone, the total energy used to mine tokens equates to almost a third of the energy consumed by the UK during the coronavirus lockdown.

This undoubtedly creates a troubling juxtaposition with the drive to decrease carbon footprints and CO2 emission levels throughout the developed world.

Moreover, it’s becoming a major issue for both the environment and the crypto space as a whole.

OK, So Exactly How Much Energy Does Crypto Consume?

If we take a closer look at BTC, which remains the world’s most well-known and trusted cryptocurrency, we can see that the basic mining and transactional processes consume between 2,000 and 2,250 Kilowatt-hours (kWh) worth of electricity at the highest end of the scale.

Based on the number of BTC transactions that took place in the year ending January 2023, the total energy consumption associated with this token peaked at a staggering 123 Terawatt Hours (TWh) or 123 billion kWh.

For context, the average UK household used 3,730 Kilowatt-hours worth of electricity annually according to figures from 2021, meaning transacting Bitcoin uses the equivalent of more than 50% of the average UK households' annual electricity.

The mining of Bitcoin annually requires 91 terawatt-hours of electricity. Again for context, the entire United Kingdom used 102.1 terawatt-hours of electricity in 2022, although it should be noted that consumption declined by 5.9% when compared with the previous 12 months.

Then there’s second-generation cryptocurrencies and noticeably greener tokens like Ethereum (ETH).

This token now benefits from using the aforementioned PoS consensus mechanism, which unlike the hardware-driven PoW method, utilises an initial investment to buy coins and build reputation.

As a result, ETH’s proof of stake mechanism only used 0.0026 TWh/yr across the entire global network, making it a much greener alternative to BTC and associated assets such as Litecoin (LTC).

How can cryptocurrency be more environmentally friendly?

As we can see, there’s a significant difference between first generation tokens like BTC and greener alternatives.

Much of this has to do with the transaction verification method used, and there’s no doubt that second and third generation blockchains are embracing more sustainable consensus mechanisms to underpin green coin tokens.

In addition to PoS, green cryptocurrencies also use Proof of Capacity (PoS), which employs the spare space on a device’s hard drive to store hashing solutions.

Then there’s Proof of History (PoH), which is employed by Solana (SOL) and encodes the passage of time itself to achieve cryptographic consensus without consuming too many resources.

In terms of retrospective changes, tokens are also embracing renewable energies. More than 56% of BTC’s energy use is now powered by renewables, while tokens are also beginning to harness stranded or wasted energy such as flared gas.

In this case, the blockchain acts as a recycler and makes use of otherwise wasted energy, which is subsequently utilised to mine new tokens.

7 Eco-friendly Cryptocurrencies in 2023

Now that you understand the concept of eco-friendly cryptocurrencies or so-called ‘green power coins’ and what separates them from less sustainable alternatives, the question that remains is which tokens lead the way in this respect?

Here’s our pick for the top seven!

#1. Cardano

Cardano is a third generation PoS cryptocurrency and the seventh-largest cryptocurrency by market cap (which peaked at $15,427,904,958 in April 2023).

Launched by the co-founder of fellow PoS token ETH, it’s renowned for its scalability and ability to process around 1,000 transactions per second, while it has the potential to scale much higher in the future

#2. Nano

Launched in late 2015, Nano is unique in the fact it offers virtually no carbon footprint or energy consumption at all. This is all because each address on Nano has its own blockchain, meaning each user provides the power to verify their own transactions.

Unlike the majority of cryptocurrencies, this allows Nano transactions to be processed without fees, making it a true trailblazer in the crypto marketplace.

#3. SolarCoin

As its name may suggest, SolarCoin is connected directly to solar energy, which remains the cheapest fuel source in more than 150 countries worldwide.

So for every verifiable, solar-powered Megawatt generated, one SolarCoin is created.

Above all, SolarCoin aims to ‘incentivise a solar powered planet’, and reward the continued shift towards renewable energy, while simultaneously reducing the cost of electricity production.

#4. Ethereum 2.0

I’ve already described ETH 2.0 as a trailblazing green crypto token, while this entity is also the second biggest cryptocurrency by market cap (which was $250,530,813,111 at the time of writing).

A 2022 update (Ethereum 2.0) also oversaw the blockchain’s switch to a PoS model, instantly making it a green and sustainable token that will consume much less power during the mining process.

#5. Hedera 2.0

Hedera is another Proof-of-Stake crypto and is owned and governed by some of the biggest companies in the world, including Google, LG, IBM, Tata Communications, and Boeing.

Operating on a high-level security system, the Hedera network is much faster than other networks, mainly because transactions are processed simultaneously rather than in a serial fashion.

The updated Hedera 2.0 ecosystem was launched at the end of last year, and it cut the blockchain into smaller segments processing up to 10,000 transactions per second while consuming just 0.001 kWh to transact.

#6. IOTA

In addition to operating a sustainable consensus mechanism that relies in part on PoW and processes transactions that require just 0.11 kWh of power, IOTA also helps local governments to measure and tackle key environmental challenges.

To this end, it utilises EnergieKnip ledger technology to enable real-time data sharing between households and local authorities, making it possible to track carbon footprints and emissions on a wide scale.

#7. Algorand

Algorand remains a relatively young cryptocurrency, released in 2019, and operating on a PoS system. Despite its infancy, Algorand, in just over a year, skyrocketed to over 1 million transactions a day (although this rate has since dropped to around 17 million per month).

The entire network was designed with energy efficiency in mind from the moment it was released, and by April 2021, it became a carbon-neutral network.

Overall, Algorand transactions require a tiny 0.0002kWh of power, surpassed only by Nano in improved energy consumption.

So What is the Most Energy Efficient Cryptocurrency?

While every single green coin listed above is sustainable and offers value from an environmental perspective, there's no doubt that Nano is the single most energy efficient.

This is because it operates a unique validation and consensus mechanism that negates the need for virtually any energy consumption, thanks to the fact that individual users are afforded their own blockchain and encouraged to verify transactions independently.

This also negates the application of transaction fees, and Nano is definitely a token that stands apart from even its green coin rivals.

What Makes a Green Power Coin?

We’ve already touched on some of the criteria that distinguish sustainable and green coins from standard crypto tokens.

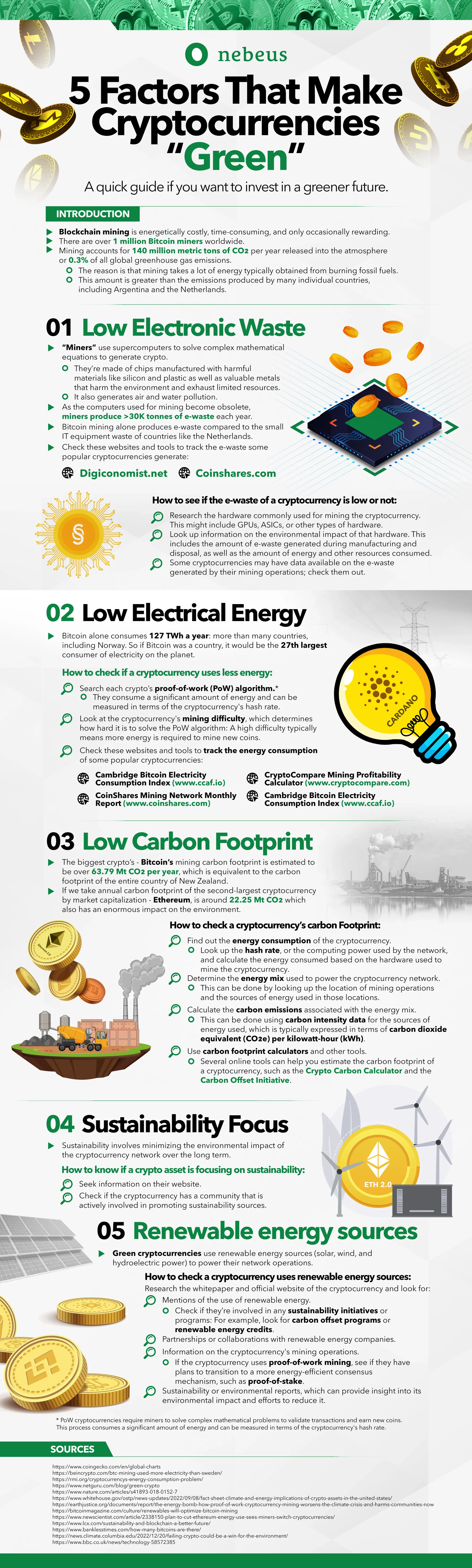

You can explore this in more detail in this infographic, but we’ve also broken down the key factors in more detail below:

#1. Low Electronic Waste

Crypto mining requires users to solve complex mathematical problems, especially when dealing tokens that deploy the PoW mechanism.

What’s more, these problems are becoming increasingly complex as a growing number of people look to resolve them, which requires miners to invest greater amounts of electrical and computational energy to remain competitive.

This also translates into increased electronic waste, which can create a significant environmental and reputational issue for blockchains (particularly first generation, PoW ecosystems).

Of course, second and third generation blockchains have responded to this challenge by embracing different consensus mechanisms, such as PoS and PoH. First gen blockchains are also acting retrospectively by harnessing wasted or lost energy, with BTC currently recycling this and deploying it to mine new tokens.

#2. Low Electrical Energy

BTC had to act to reduce its consumption, as it has historically been associated with high levels of electrical energy and usage.

Remember, the total BTC transactions processed through 2022 consumed a staggering 123 billion kWh, while each single transaction utilises between 780.02 and 2,000 kWh on average.

Conversely, newer green coins are renowned for their incredibly low levels of electrical energy consumption.

In addition to Nano (which almost completely eschews energy consumption and standard consensus mechanisms), Algorand transactions consume as little as 0.0002 kWh of power per transaction, while the corresponding figure for Hedera 2.0 is just 0.001 kWh per transaction.

#3. Low Carbon Footprint

The carbon footprint of cryptocurrencies comprises a number of different factors, in addition to the levels of electricity required to mine and maintain tokens and verify transactions.

Respective carbon footprints are also based in part on any additional pollution or local impacts that directly affect cumulative greenhouse emissions, including any noise that may have a negative impact on regional communities.

Of course, some tokens have gone further in lowering their carbon footprints, including Nano and SolarCoin.

The latter has adopted a novel approach to cryptocurrency management, by creating a single token for every Megawatt hour that’s generated from solar technology.

Although the process of proving energy generation is currently cumbersome and paper-based, it’s hoped that the IoT may deliver greater automation in the future.

#4. Sustainability Focus

Many third gen cryptocurrencies and green coin options like SolarCoin have been developed with a sustainable focus in mind, and this is a key consideration when appraising genuinely eco-friendly cryptocurrencies.

Of course, a sustainable focus and mission statement must also be backed by the fundamentals referenced above, such as reduced electricity consumption and minimal carbon footprints.

For example, a single Nano transaction can be powered using a minuscule 0.00011 kWh of power. Conversely, a single BTC transaction requires 2000+ kWh on average, highlighting the difference between the two tokens and how a sustainable green coin should function on a practical level.

#5. The Use of Renewable Energy Sources

Of course, SolarCoin is also an example of how cryptocurrencies can harness renewables to their advantage while subsequently minimising their reliance on electrical energy.

More recently, BTC and similar first generation blockchains have also looked to integrate renewable energy such as sun and wind power.

In the case of BTC, some 56% of the blockchain’s energy usage was powered by renewables as recently as 2021, while a growing percentage was also driven by recovered or wasted energy.

These characteristics define green crypto tokens and distinguish them from standard alternatives, while you can learn about this in the infographic below.

The Bottom Line: The Future of Greener Cryptos

While many of the most established cryptocurrencies continue to require approximately a family home’s power to operate, there are currently much better alternatives.

With thousands of existing tokens out there, more of them will switch to PoS, and new cryptocurrencies will continue to materialise. If you’re looking to invest while minimising your carbon footprint, it is easier to do so than you may have previously thought.

You can sign up for a Nebeus account to buy, send and hold some of the most eco-friendly cryptos.

La inversión en criptoactivos no está regulada, puede no ser adecuada para inversores minoristas y se puede perder la totalidad del monto invertido.