At Nebeus, we've looked into the purchasing power of digital nomads across the globe by comparing their earnings with the expenses in the temporary residence locations.

In this study, you'll discover the most popular professions among digital nomads, their nationalities, top travel destinations, and how their cost of living and earnings stack up against fellow nationals pursuing the same career back home.

Digital Nomads: Most Popular Professions

Any profession that doesn't require physical presence is an excellent choice for working from anywhere in the world. However, there are some that stand out as the quintessential jobs for remote workers. From marketing roles to writers or consultants, digital nomads only need a computer and an internet connection to perform their tasks.

Favourite Destinations: It's Not All Sun and Beach

Digital nomads often choose countries to live in temporarily and work remotely where the cost of living is low but where leisure options and climate are better than in their home countries.

Paradise destinations like Thailand, Malaysia, or the Philippines are among the most popular options according to the largest community of digital nomads, Nomadlist.

However, there are many more:

Nomadlist analyses the most popular options among digital nomads, which in 2024 are mostly divided between Southeast Asia, Central and Southern Europe, and Latin America. Historically, these countries have a much lower cost of living compared to the nationalities of the nomads, making them very attractive options for those who prefer to live a less stressful and more adventurous life while allowing them to save more money than in their home countries.

43% of digital nomads come from the United States

Just as there's a trend of countries where digital nomads temporarily live and work remotely, there are also clear demographic profiles of those who decide to become digital nomads. With 40 million nomads worldwide according to Pumble, the United States leads the list of nationalities with over 43% of digital nomads globally.

The New Rich: Digital Nomads Save Up to 50% More Than You, Despite Earning 30% Less.

If a worker lives in a country with a low cost of living but maintains the same salary as in their home country, that person will generate greater profits with the same amount. But how much more do remote nomads earn than in their home country?

Let's take a look.

In this scenario, we start with the premise that both workers with the same profession earn the same but have different costs of living, thus one saves more than the other.

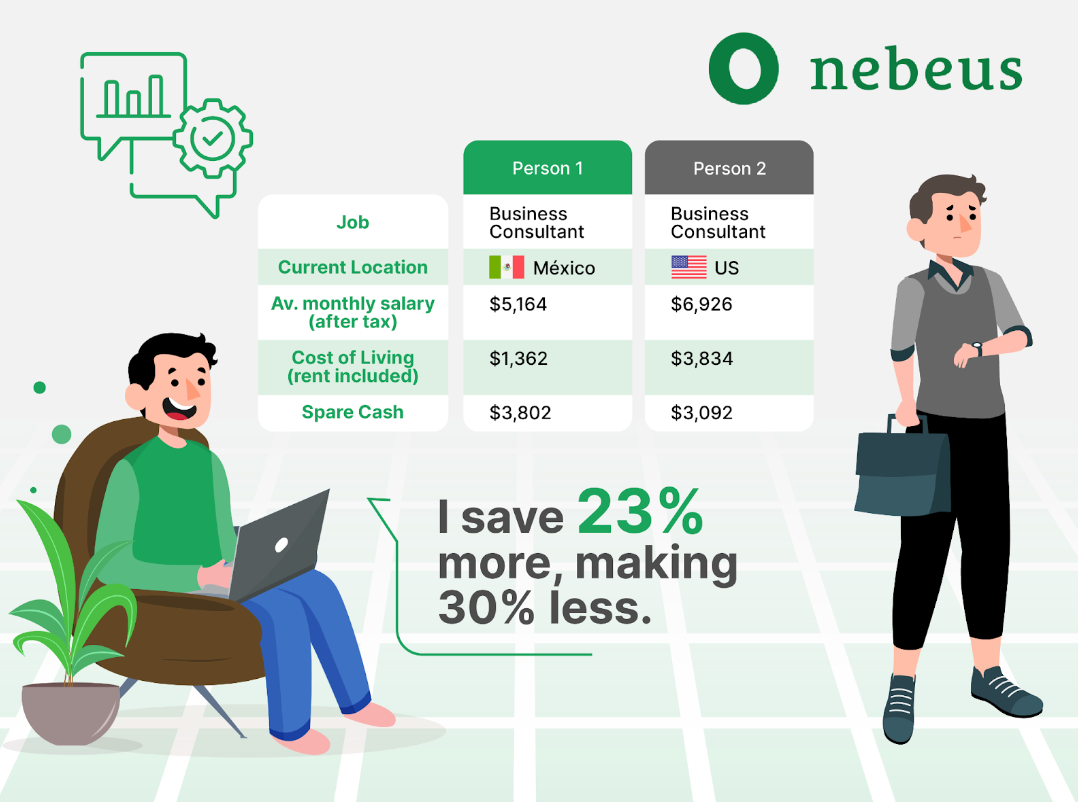

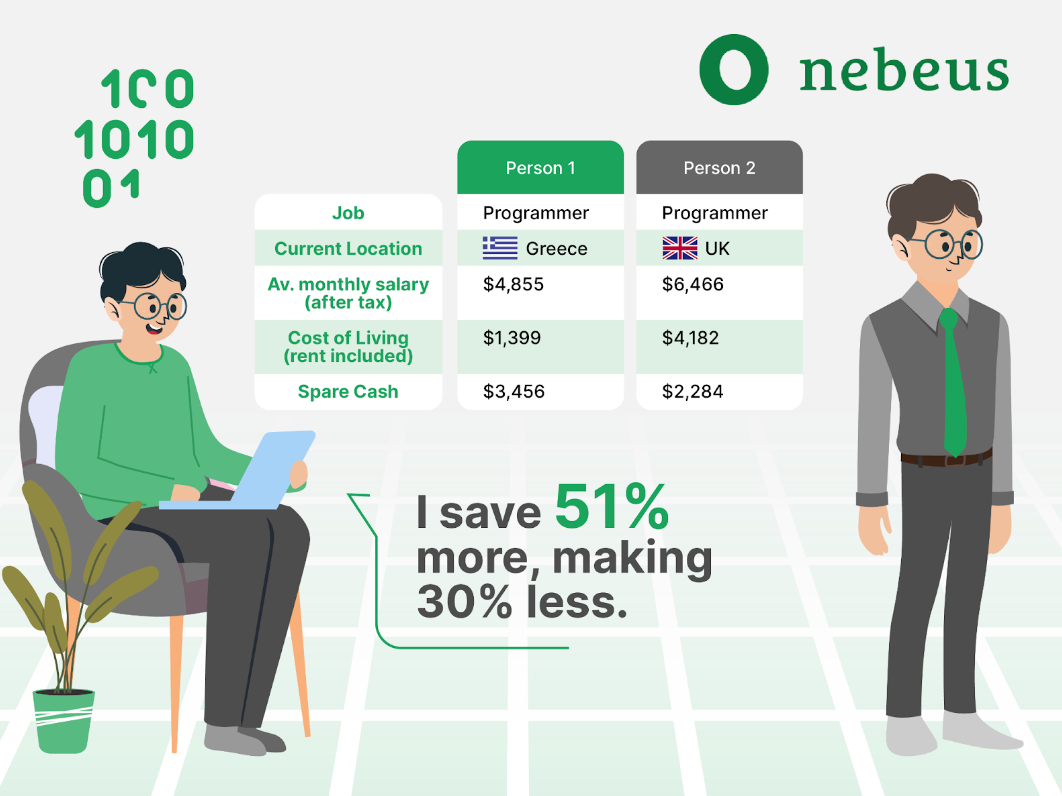

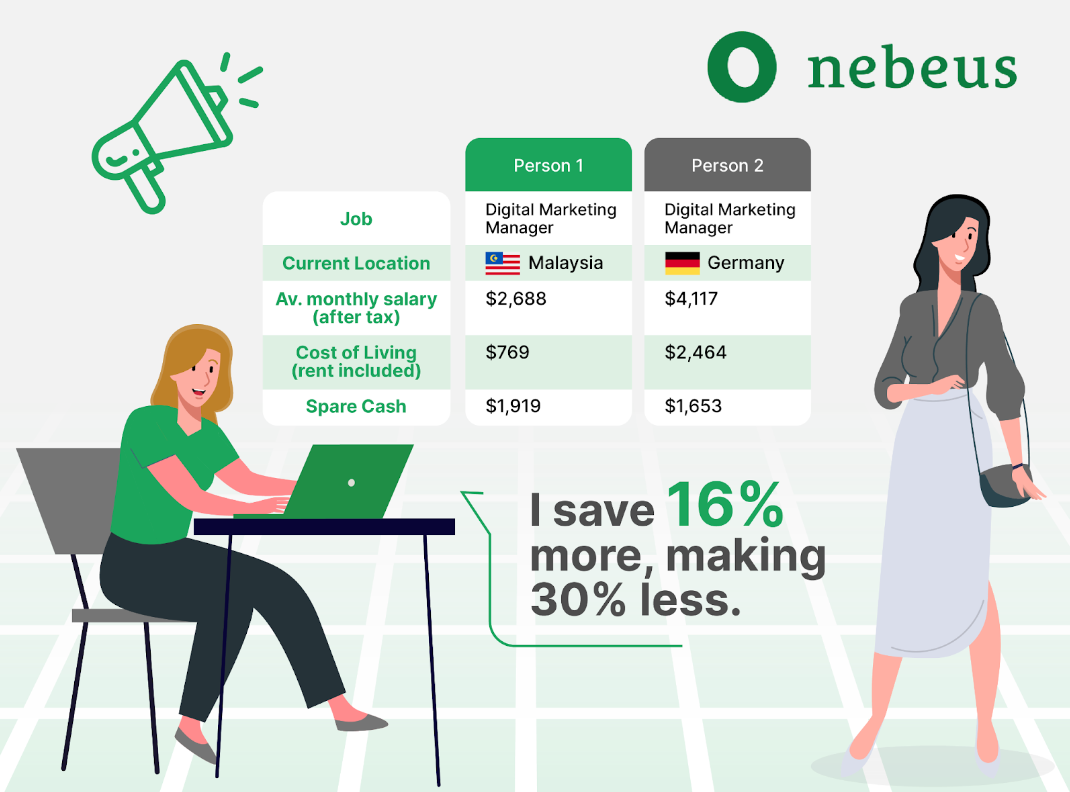

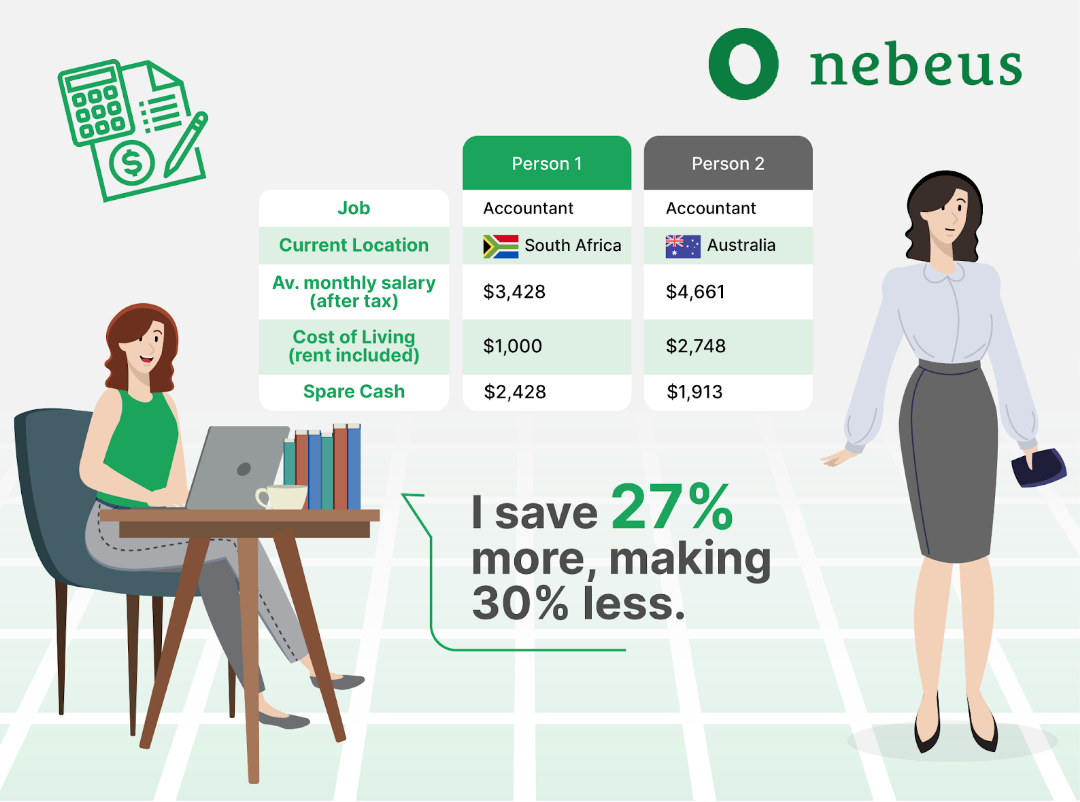

What Happens If Digital Nomads Earn 30% Less Than They Would at Home?

Even if digital nomads earn 30% less than their counterparts in their home countries, they often end up with up to 50% more disposable income at the end of the month. This increased purchasing power can make them financially better off than if they had stayed in their home country.

We have illustrated this with four practical cases based on real data, which reflect actual scenarios:

Where do digital nomads pay taxes?

One of the biggest stereotypes about digital nomads is that they don't pay taxes. But how close to reality is this claim?

As a general rule, in most countries, a citizen is considered a tax resident as long as they spend no more than 183 consecutive days outside their country. However, not all countries operate this way.

For example, in the United States, tax residency depends on nationality, so American digital nomads always pay federal taxes regardless of how long they have been living abroad.

Similarly, getting rid of tax residency in one's home country is sometimes not as simple as residing abroad for more than 183 days. In some cases, having a family established in that country or real estate may be reason enough to continue paying taxes.

In addition to national taxes, the tax conditions of the countries of residence must be considered. In most cases, any individual can stay up to 90 days in their chosen country as a tourist, in which case no tax payments are considered.

Some countries, such as Colombia, Brazil, Costa Rica, Spain, or Thailand, offer special visas for digital nomads. As a general rule, those with this type of visa and whose income does not come from any national company in the country of residence will not have to pay taxes in that country for the duration of their visa.

For the examples above, we have assumed that the digital nomad spends less than 183 consecutive days outside their home country and therefore has to pay national taxes. However, each country has different tax rules, so we recommend visiting official government websites for more information on tax payments in different home and destination countries.

How Do Digital Nomads Manage Tax Payments?

Paying taxes can be a challenge for digital nomads, who often have to navigate different tax systems as they travel. Fortunately, most countries facilitate timely tax payments through various convenient methods.

In the United States, for instance, the IRS accepts payments via third-party processors for debit and credit card transactions. Similarly, Spain and other European nations offer a wide range of payment options on their websites and at physical offices.

While the paperwork can be complex, the process tends to be designed to make it as straightforward as possible for taxpayers to fulfil their obligations.

One significant challenge for nomads is managing multiple currencies. Typically, they earn in one currency but must pay taxes in another. Official exchange rates provided by central banks are generally used for these conversions, with the individual responsible for making the necessary currency exchanges.

Tools like Nebeus’ account for freelancers can be extremely beneficial in this context.

Nebeus allows freelancers and digital nomads to effortlessly exchange fiat and cryptocurrency, make and receive global payments through a multi-currency account, and manage their finances efficiently from anywhere. The platform also offers features like invoicing, which simplifies billing and monitoring of payments, and provides a free personal virtual IBAN for EU residents.

These tools are particularly helpful for staying organized with financial commitments and tax obligations. Digital nomads can easily track their earnings in different currencies, calculate due taxes, and maintain comprehensive records of all transactions, ensuring they never miss a payment deadline.

LATAM and the Caribbean: Among the Destinations with the Largest Digital Nomad Population

Latin America and the Caribbean have become one of the favourite areas for remote work in recent years. It's no surprise, as 16 countries offer special visas for those who decide to temporarily live there.

Indeed, Mexico boasts the largest digital nomad population in Latin America and one of the largest in the world. According to Xataka, in 2023, Mexico had over 90,000 digital nomads, bringing in more than $500 million USD to the region.

Argentina ranks as the third most popular destination worldwide in 2024 according to Nomadlist, closely following Mexico in density. In 2022, Argentina attracted over 72,000 digital nomads, a 650% increase from the previous year.

Colombia, on the other hand, expects to attract over 45,000 remote workers in 2024 thanks to the introduction of its "digital nomad" visa. Brazil, Costa Rica, Ecuador, Panama, and Peru are other countries that have also launched programs to attract digital nomads. But why are all these countries so attractive?

Earning Less, Living More

Greater savings and potential tax advantages are not the only reasons why more and more people are choosing to become digital nomads.

In our study on British nomads' choice of destinations, the main reason they choose, for example, Spain, is not purely economic, but rather an improvement in their quality of life. This includes mundane things like not having to waste time commuting to their workplace or being able to choose daily whether they work from home, a café, or from a hammock on the beach.

Travelling the world, experiencing new cultures, and having a flexible schedule are among the many reasons to give this lifestyle a try.

Choosing Latin American, Caribbean, and Asian countries to embark on these adventures makes perfect sense.

Methodology

To determine purchasing powers, we utilised data from reputable platforms and various government organisations that publicly display such information, including: Nomadlist, Numbeo, Talent, ADP, Seek.com.au, tax.service.gov.uk, and Brutto Netto Rechner.

For comparisons, we analysed the cost of living in the most popular countries among digital nomads, as well as the cost of living for the most common nationalities among digital nomads, using the platform Numbeo.com, which provides the average net cost of living each month in those destinations.

For mathematical calculations, we considered that digital nomads reside in their destination country with a tourist visa and have not spent more than 183 days outside of their home country, so they are required to pay the same national and regional taxes as their compatriots. To do this, we used average values with respect to the gross salary of different professions provided by Talent.com, projecting them to a monthly net salary through the use of government platforms for tax calculation, and the net cost of living data acquired through Numbeo.