2020 has been a total paradigm shift year. While the world adapts rapidly to “new changes”, the financial infrastructure of the globe has been pushed to its limits. As digitalization has become a hot topic, some are putting their hopes on new financial technologies and markets. As the end of the year appears on the horizon, a glimmer of 2021 has begun to take shape. With the Cryptocurrency Market growing exponentially, more and more people are putting their money on this field, since it’s one of the most exciting innovations of our time. But the market is a volatile one. One day it peaks and another one it goes down. Some investors decide to sell shortly after the price goes drastically down through seasons, while others decide to not give up and continue storing it. Yet what do you do if you need cash but don’t want to give up on your crypto? This dilemma sparked the need for a new type of financial services: “Crypto Loans.”

What is Crypto Lending?

Up until recently, crypto users traditionally only had two options regarding how to use their crypto: hodl or trade. Particularly for hodlers, cryptocurrency has had one function — i.e., to sit in their wallets. While some may argue that serves a purpose by limiting supply on the market, we can generally agree that it is not a particularly productive use of a capital asset. With the surge of crypto lending, the utility of those assets has increased significantly. Borrowers can receive fiat without having to initiate a sale. These are substantial improvements for individual hodlers and the Crypto Market alike.

How does Cryptocurrency Lending Work?

Crypto lending works just like traditional banking loans, but instead of fiat money it involves crypto and it connects borrowers and lenders via an online platform. In some cases, like Nebeus and the crypto lending platforms mentioned here, the platform itself acts directly as a lender. Crypto lending can differ, but what remains constant is the core concept: a lender (platform) makes its assets available to loan at a certain rate.

Which are the Best Crypto Lending Platforms?

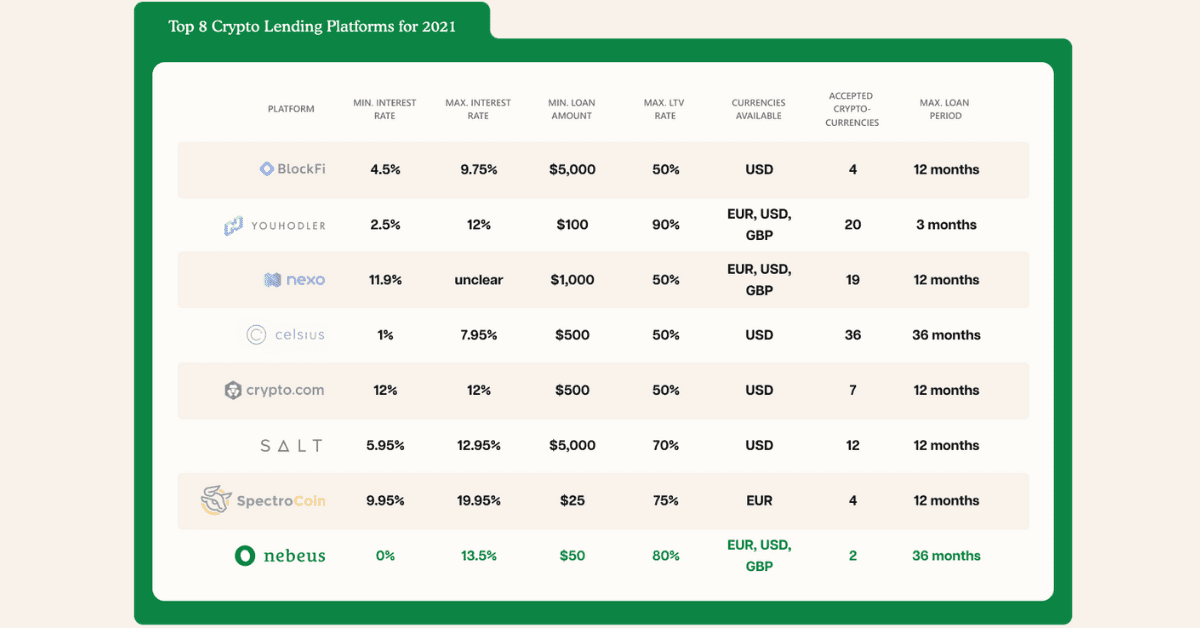

For the last few years, crypto lending has massed a significant amount of attention and is increasingly becoming a mainstream conversation for banking and institutional investors. With this new hype, many new crypto lending platforms are popping up and are getting immensely popular. Today, there is quite a range of crypto lending platforms that exist. But what differentiates them? Why choose one over the other? Which one is the best crypto lending platform that suits me? So many questions, but one answer: it all depends on what you are looking for. The below list comprises the top crypto lending platforms that are lately making noise. If you are thinking of trying out crypto lending for 2021, these platforms may provide you with the best starting options, so take a look.

Nebeus

Nebeus’ Interface

Nebeus is a crypto lending platform based between the UK and Barcelona. Our main goal is to bridge the gap between crypto and cash and provide people with financial services for their everyday use. We build all of our products and features with the “everyday” idea in mind. When looking at the terms of our loans, we have one of the highest LTV ratios in the Market (80%) and one of the lowest interest rates, starting at 0%. Loans are pre-approved, and the only thing that a user needs to do is either:

1. Confirm the loan by adding money to the account with a transfer or bank card and buying crypto on Nebeus.

2. Transferring crypto from another wallet.rring crypto from another wallet.rring crypto from another wallet.

The process is quick and seamless. Our users have the option of getting 2 types of loans: Quick Loans and Flexible Loans. Users can borrow as little as €50 for 3 months at 0% interest and an early repayment option with a Quick Loan. Flexible Loans have a more advanced calculator giving people the possibility to select their own terms and borrow up to 80% of their Crypto value for up to 36 months. Once a loan is approved, and funds are received, more fun begins. Nebeus allows you to make transfers to any bank account or card in over 150 countries. Cash can be sent for pickup at retail points and post offices at around 230,000 locations worldwide. You even have the option of topping up your phone, using your cash, or your crypto. Nebeus primarily operates in Europe, with the bulk of our customers from the UK, Germany, and Spain.

Pros:

- Instantly pre-approved loans

- Very high LTV ratio – up to 80%

- Lets you borrow as low as €50 or the currency of your choice ($ or £), with 0% interest

- Access to a wide range of financial services such as: transfers & deposits at more than 230,000 retail points & post offices, and even mobile phone top-ups using both crypto and cash.

Cons:

- Only 2 cryptocurrencies available (Bitcoin and Ethereum)

- Does not allow SWIFT transfers

- Do not give perks such as cashback rewards.

BlockFi

BlockFi’s Interface

BlockFi is a United States based crypto lending platform that operates in almost all of the U.S.A except for 3 states. It also operates in most of the world, except for sanctioned or watch listed countries. BlockFi allows crypto owners worldwide to open their accounts and deposit funds, which they host using an institutional custodian called Gemini. BlockFi’s website offers straightforward functionality, although they do not display the amount of Bitcoin held. Instead, they show the USD value of the Bitcoin, which is a catch for some. Once you get a loan, you are able to make wire transfers and withdraw your funds at any given time. Nevertheless, you only get one free withdrawal per month. If you need more withdrawals, you need to pay a fee. In addition, some see BlockFi as quite limiting. The initial investment to get a loan is of $5,000, which is a very high amount compared to others. On the other hand, LTV is only 50%.

Pros:

- Trusted. They make a lot of focus on this point and take pride in their security.

- Allows for anytime withdrawals.

- Wire Transfers.

Cons:

- Low LTV (50%).

- High initial investment amount to get a loan ($5,000 minimum).

- Limited collaterals and currencies.

- Users get only one free withdrawal per month.

YouHodler

YouHodler’s Interface

YouHodler is a Swiss-based crypto lending platform that allows users to borrow fiat funds based on the value of their cryptocurrency asset holdings. One can convert crypto to crypto, crypto to fiat, and also engage with stablecoins. It’s good to note that if you don’t have the crypto you wish to deposit, you can convert from another crypto or FIAT currency. It supports 4 FIAT currencies, 6 stablecoins, and 15 cryptocurrencies. With YouHodler, users have the option of repaying their loan in 1, 2, or 3 months, with the possibility of extending. Extending costs an extra fee. As per LTV, YouHodler offers a high rate (90%) but only if you repay the loan in the next 30 days, which might limit users to small loans due to a short repayment period. The longer the duration of the loan, the lower the LTV. Thus, from 3 months and on, LTV is 50%. This crypto lending platform is available to customers worldwide except the United States, China, and Bangladesh. One of the main disadvantages users have noted using YouHodler, is that you don’t own the private key to your crypto wallet.

Pros:

- High LTV if you can quickly repay your loan.

- Competitive interest rates.

- Diverse cryptocurrencies.

- User friendly.

Cons:

- Lower LTV if you choose to pay your loan in longer than 30 days.

- Short time span to pay loans. You can lengthen your loan period, but this costs a fee.

- No private keys.

Nexo

Nexo’s Interface

Nexo is one of the crypto lending platforms that has been out there for a while. Nexo Services OU operates under the Estonian jurisdiction, although the website is registered in the Cayman Islands. Loan amounts are from $1,000 up to $2,000,000 as a max limit amount. They advertise interest rates as low as 5.9%, but be careful as this only applies if you own Nexo tokens. If you’re not interested in their native tokens, then interest rates will go up to 11.9%. Nexo’s “Oracle” algorithms dynamically determine loan limits. They take into account the current and historical volatility and market liquidity of the particular assets you plunked down as collateral and give you a loan limit based on all those factors. A benefit from Nexo is that when you deposit your crypto assets into an account, your assets are held in cold storage in collaboration with a third-party custodian BitGo which is SOC 2 Type 2 certified. When it comes to downsides, Nexo users have complained about its hidden fees regarding Nexo tokens, a limited number of collateral crypto wallets, and limitations when it comes to cash withdrawals.

Pros:

- They are a certified institution (although there no links to their certificates can be found).

- Can loan large amounts of cash, if you own a sufficient amount of crypto.

Cons:

- LTV of only 50%.

- User limitations.

- Hidden fees – low interest rates are just for users who own Nexo tokens.

Celsius Network

Celsius Network’s Interface

Celsius Network was launched back in 2017 as a mobile application and crypto wallet. Over time, they have incorporated crypto lending into their services. Something remarkable about Celsius Network is their versatility when it comes to available cryptocurrencies, as they work with 36 different currencies. However, Celsius Network offers a relatively low loan-to-value ratio that falls between the range of 25-50%. It is worth noting that their entire loan system is based on their native token CEL. In order to get the advertised rates and benefits from Celsius Network, you not only need to have CEL tokens, but you also have to stake them. This is where it starts getting tricky, as it forces you to be part of their loyalty program. When you are not using CEL tokens, you cannot access Celsius Network’s best benefits.

Pros:

- Versatile. It has plenty of collateral options.

- Low interest rates when you’re part of their loyalty program.

- Flexible terms.

Cons:

- It only works as an app.

- You can only access benefits and low interest rates if you own their tokens.

- Limit on withdrawals larger than $20K.

Crypto.com

Crypto.com’s Interface

Crypto.com is an all in one platform that offers various services ranging from buying, selling, exchanging, and lending cryptocurrencies. Stakeholders can invest in the platform’s native currency, CRO, and benefit from interest rates as low as 8%. If you want to use crypto other than CRO, then interest rates will be 12%. On Crypto.com, there’s no set deadline to repay the loan. A user can set their repayment time for whenever they want, throughout the course of 1 year. Nevertheless, if you fail to pay the loan within 1 year, or at least 85% of it, Crypto.com will liquidate your collateral. This crypto lending platform has an online environment and a mobile application for iOS and Android, enhancing the easy transfer of tokens from your wallet to Crypto.com and vice versa. Another benefit is that they have a partnership with VISA and have their own debit cards. All cryptocurrencies are converted to US Dollars, and the US Dollars can be loaded onto the MCO Visa Card. Users can then spend their money on purchases and withdraw cash at ATMs. They also have up to 5% cashback rewards with their debit card on certain services like Spotify or Netflix (but the cashback is paid in Crypto.com’s CRO tokens). Something important to note is that not all Crypto.com features are currently available everywhere. Users should check which services they have access to depending on their region before using the service.

Pros:

- Supports deposits with crypto and cash via the Crypto.com app.

- VISA card can be used for payments and cash withdrawals.

- Up to 5% cashback rewards with their debit card (only in CRO tokens).

Cons:

- Maximum loan period of 12 months with no option to extend.

- Most of their products are not fully available in all jurisdictions.

SALT Lending

Salt Lending’s Interface

Created back in 2016, this United States native crypto lending platform offers the possibility to take individual or business loans. Customers are able to open loans against their cryptocurrency holdings in exchange for USD. Loans are available between $5,000 and $25,000,000 with a repayment window anywhere between 3 and 12 months and a Loan-to-Value between 30-70%. Users can find this minimal loan amount relatively high. Repayments are available as interest-only payments or interest-plus-principal payment options. A convenient Loan Calculator can be found on SALT’s website to discover exact rates. One unique feature that SALT offers is full insurance for customer funds. SALT offers both Crime Insurance (in the event of theft or infrastructure issues), as well as Cyber Liability Insurance (in the event of a breach or threat). This can help put customers’ minds at ease, as SALT claims that user funds are 100% safe. A limitation of Salt Lending is that while they mainly operate in most of North America, their platform is limited for the rest of the world. They only have a presence in Brazil, Switzerland, the UK, United Arab Emirates, Hong Kong, Australia, and New Zealand.

Pros:

- Full Insurance.

- 2 repayment options.

- Counts with a health loan indicator and real time notifications.

Cons:

- $5,000 initial investment to get a loan.

- Globally limited.

- Globally limited.

SpectroCoin

SpectroCoin’s Interface

Founded in 2013 and headquartered in London, SpectroCoin is a platform that includes an electronic wallet, a prepaid debit card, currency exchange, and cryptocurrency brokerage. SpectoCoin has recently partnered up with Bankera Loans to offer blockchain-based cryptocurrency loans and introduce themselves into the arena of crypto lending platforms. Interest rates start from 9.95% and go up to 19.95%. You can opt for an LTV ratio of 25%, 50%, or 75%. As we know by now, the higher your LTV, the higher your interest rate. High rates also apply for small loans under €1000. Loan amounts range between €25 and €1 million. Loans are issued for periods of one year but can be repaid early. Also, loan periods are extendable. SpectroCoin has a friendly calculator on its website that helps users choose their preferred terms. A significant drawback to note and that some users might dislike is that you’ll have to face higher interest charges if you decide not to pay interest in Bankera coins (BNK), which are their native tokens. For example, if you take a loan with a 9.95% default interest rate, you would only have to pay 6.95% if the interest is paid in BNK. As the interest is debited automatically every month, you have to make sure that there is a sufficient amount of BNK in your SpectroCoin loans wallet.

Pros:

- Flexibility. You can choose the interest rate, loan term, loan amount, repayment method, and more.

- Loans can be repaid in euros or cryptocurrency.

Cons:

- Low interest rates are an advertising technique to own their native tokens (BNK). If not, interests can go as high as 19.95%.

- Must own Banker (BNK) tokens to get the best benefits.

Conclusion

If you need cash and you own some crypto, now you know what you can do. The list of crypto lending platforms does not stop here, as there are many more out there. We believe there is no best crypto lending platform. Your choice of platform depends entirely on your needs, how fast you need a loan, and the type of digital currency you own. Money makes the world go round, they say. And crypto is no different. As the new year approaches, the in’s and the out’s of earning and managing digital assets are getting more straightforward and easier by the day. In the meantime, we invite you to try out our own services.

See you soon on Nebeus!